What happens Once you Refinance Your vehicle Loan?

Trick Takeaways

- Your brand-new bank pays their dated mortgage away from really. You don’t have to care about it any further.

- There are many different details and this can be played with.

- One of many head products lenders check when deciding whether to increase borrowing from the bank can be your Personal debt so you can Earnings Proportion.

You’re thinking about refinancing the car for reasons uknown – a lower interest rate, top terms, to changeover out of a rent so you’re able to control. Those things happens when you will do you to? What are the results on dated financing? What takes place with the borrowing from the bank? Speaking of a few of the points that occurs after you refinance your vehicle mortgage.

The new Lender Pays Out-of Your Old Auto loan

Your lender pays the dated loan from myself. You don’t need to worry about it more. You only work at when and the ways to spend your brand-new financial. The one and only thing you will want to value try requesting papers or other proof appearing this fee and you may identity import is actually made.

A separate Car loan Might possibly be Created

Your brand new financial requires extent due on old loan, adds the fresh new appeal and you may amortizes they underneath the regards to the latest financing. What if you purchased a car or truck for $20,000 at the 8% notice to possess 60 months along with become purchasing $406 monthly to own a year.

You are today down seriously to 48 days and you may $15,one hundred thousand. Your brand new bank gave mortgage off 3.5%. Your percentage only become $335 thirty day period. Alternatively, both you and your financial you’ll agree to more conditions. You could potentially stretch the mortgage right back over to sixty weeks and you may just be investing $273 a month.

Additionally, according to lender, age and come up with of one’s automobile and its particular mileage, you may not be able to get a lower life expectancy interest rate otherwise a longer identity, so it’s crucial that you glance at their funding selection in the first years of your getting it automobile.

There are many different details which are enjoyed, from identity so you can interest rate, to your downpayment. Much utilizes the age of the auto, your current credit score as well as your personal debt to money ratio.

Your credit history Might be Removed

- A loan provider or loan providers take your credit report is called a difficult inquiry that can affect your credit score. Any moment anyone brings your credit score, it will possess a negative effect-even when always restricted and you will short-term.

- The old financing would be repaid, and you may a unique financing might possibly be established in the set.

- Your brand-new loan would be detailed by the the credit agencies because an alternative membership. Too many this new membership inside a period make a difference to your credit score.

Unless you’re undergoing bringing a home loan otherwise applying to own numerous other borrowing from the bank profile inside a preliminary period of time, refinancing your car finance must not have an awful effect on your credit score.

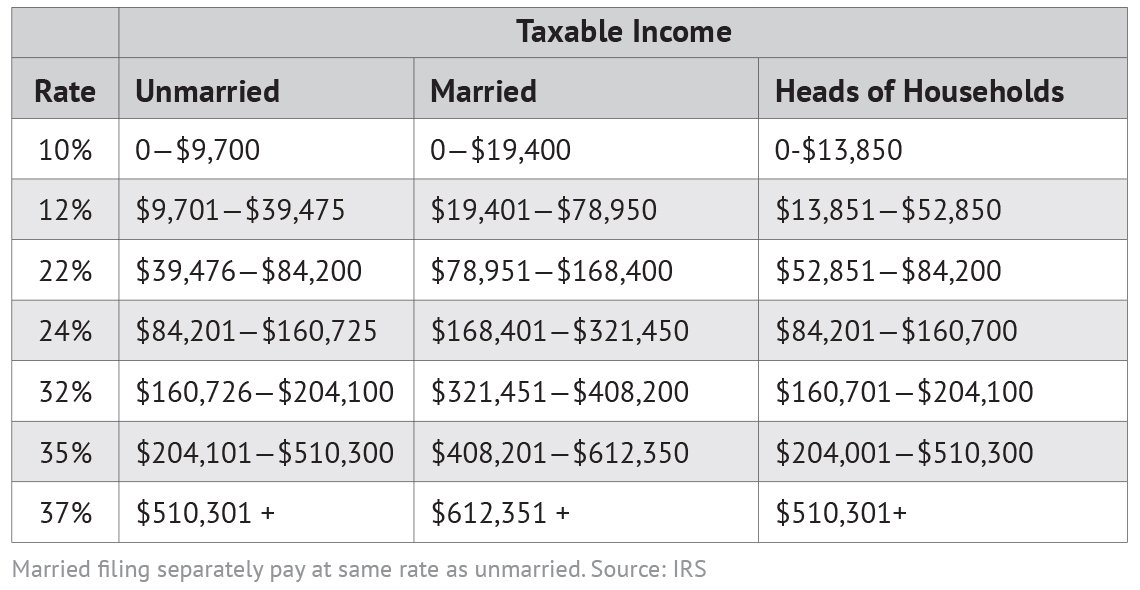

Among chief activities loan providers evaluate when choosing whether or not to increase borrowing from the bank is the Obligations in order to Earnings Ratio. DTI relies on adding up your month-to-month financial obligation repayments and breaking up the sum by the money. More money you borrowed from in financial trouble every month, the higher your own DTI. Very loan providers look for a great DTI not as much as forty%. For many who re-finance along with a lower payment, you to cuts back your month-to-month loans, ergo, a lesser DTI.

You’ll be able to Shell out a decreased Payment

When you find yourself closing costs for the a mortgage refinance should be pricey, expenses associated with refinancing your own vehicle is restricted online loans San Jose Arizona. Your lender might charges a little application percentage to possess move their borrowing from the bank, plus one, perhaps, having pull research on your auto to ensure it has not been in any sort of accident who reduce its really worth. There could be several other short fee to possess move this new term away from your current bank towards the the bank. However, with one, you’re probably thinking about lower than $100.

Refinancing an automible is much simpler and shorter than just refinancing a good home. Although not, they however need careful searching for best lender while the proper words. No matter if one the fresh new financing can have an impact on your own credit get on short-run, providing a much better financing plan is help your credit history ultimately. If you want to learn more about automobile refinancing, contact us!