two to four Unit Virtual assistant Multiple-Unit Conditions | Va Mortgage

2 to 4 Tool Virtual assistant Multi-Equipment Requirements | Virtual assistant Mortgage

Looking for a 2 in order to cuatro equipment assets and you can simple tips to receive a great Virtual assistant financial? A qualified Seasoned can buy capital to possess a beneficial Virtual assistant multi-product loan when they are likely to entertain that of your systems. Virtual assistant multiple-device standards make it Pros to finance around 100% loan-to-value while increasing the income by leasing out the other gadgets.

5 Measures to a quick Pre-approval to possess an excellent Virtual assistant Multiple-Tool Loan

step one st action: when you have perhaps not already, obtain a certification out of Qualifications (COE). You can do this by making use of on the internet from the eBenefits Portal or expediting the procedure by talking to a talented Mortgage Creator that has accessibility the latest WebLGY Program.

2 nd step: you ought to query that loan Inventor to own a summary of papers you’ll need for good Va multiple-tool mortgage. They inquire about a list of records needed for processing and you will underwriting the Virtual assistant multi-unit mortgage.

- 30 day pay stubs.

- Past a couple of years tax returns and you can W2s/1099s.

- 401k and you may resource membership.

- Copy from photos ID.

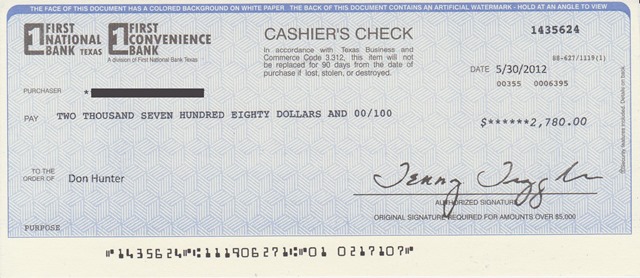

- two months examining/savings account statements.

- Honours emails (SSI/pension/disability).

- Va Certification of qualification.

- Other documents based your own instance circumstance.

step three rd step: shortly after sufficient paperwork and you will suggestions could have been attained, financing Inventor is going to run the latest Automated Underwriting Program (AUS) to determine the Virtual assistant mortgage eligibility. Brand new automatic underwriting method is a risk centered system that assesses credit, strength, and you may guarantee. This system should determine when you’re eligible to a Virtual assistant financing in many cases a Va mortgage should be by hand underwritten.

There clearly was an option to get a rock-hard pre-acceptance with an underwriter comment what you, although property. This could be known a towards-Be-Calculated (TBD) pre-approval. This often takes pressure off of the stop of your processes since things have been analyzed, however the property.

4 th step: one of many latest actions into the pre-recognition process will be provided an excellent pre-recognition letter to own a beneficial Va multi-device domestic. For people who pursue these types of steps ahead of looking for a good Va multiple-equipment house, funding will go a lot much easier.

Often, new pre-recognition process or guidance are different from the bank, which particular mortgage organizations enjoys an inside assistance towards the top of Va direction entitled an enthusiastic overlay. An example of a beneficial Va overlay is demanding the very least credit score.

5 th action: unless you curently have an agent, the borrowed funds Inventor helps you get in contact with you to to begin with looking for property.

Reserve Standards

Dollars supplies are not constantly expected, in some cases they are. It is calculated when you look at the pre-recognition procedure when that loan Originator works the automatic underwriting system. Set-aside criteria depends to your of a lot circumstances, although not limited by playing with leasing money of one’s dos-4 unit assets in order to meet the requirements, borrowing from the bank, capability, and you will equity.

Having fun with Leasing Income in order to Meet the requirements

Potential earnings can be regarded as effective income which have a good Va multiple-device financing. When using the subject features prospective leasing money, Virtual assistant multi-unit advice condition:

- This new applicant need evidence you to definitely means the likeliness regarding victory being a landlord.

- Which have at the least six months mortgage payments in supplies.

Brand new rental income can be regarded as effective money according to the less out of 75 percent of the verified previous lease built-up otherwise this new appraiser’s thoughts out-of reasonable business rent. Va multi-unit financial recommendations act like FHA two to four product recommendations.

Good Pre-Acceptance to own good Va Multi-Equipment Financial

Particular lenders commonly make pre-approvals centered http://www.paydayloanalabama.com/satsuma on verbal guidance, that can bring about worry for the home loan process and you can result in a last time denial. After a seasoned is safely pre-acknowledged, it is important to keep in mind that because it qualify, it doesn’t mean every services often. Experts should make sure which they work with a representative exactly who knows the basics of Virtual assistant approved multiple-device homes.