Can be Canadian basic-big date homeowners get into industry that have student loan financial obligation?

On twenty-five, I got an excellent suggestion to go back to school to own advertising. Eight weeks and you will an effective $20,100 student loan later on, We graduated that have no interest in doing Advertising, an outstanding summer internship (needed to graduate), with a great humbling work lookup you to definitely pulled toward to possess weeks. During the a job interview using my coming company, I found myself expected what my personal paycheck requirement was basically. Minimum wage? I told you, and i thought she laughed.

My personal story isn’t special. Every spring season, students dump its hats and you will clothing and step to the real business that have normally $16,727 in financial trouble, according to Canadian Federation out of Pupils. It requires them to fourteen many years to settle (according to research by the mediocre entryway-peak income away from $39,523) – top of several to get out-of goals eg carrying out a household and you may purchasing assets.

I am currently preserving to possess a deposit into a cottage inside the Ontario – the foundation behind all of our the newsletter all about the newest rise into the or over the home steps (subscribe here!). To simply help myself dive along the student loan difficulty to track down to homeownership, I inquired Lisa Okun, an effective Toronto-centered home loan agent, and you can Jessica Moorhouse, a beneficial Millennial currency pro, to own pointers.

So, how much cash personal debt are Canadian people indeed accumulating?

For the a get older out of rising rates of interest and you will difficult financing guidelines, Canadians try against high traps so you’re able to home ownership in major Canadian towns and cities. Few by using lingering pupil financial obligation and it can end up being near impossible.

Register for Ladies into the Ladder, the first newsletter neighborhood so you can transmit the newest diverse voices of females who’ve climbed the property steps.

By 2016, 490,100 full-date children obtained a total of $2.eight mil into the government-financed finance. The moms and dads was once capable pay back their tuition – and that averaged doing $step one,000 a year – which have june perform. Today, the typical university fees to have a beneficial Canadian school – up until the cost of instructions, traveling and you can provides – is $six,500 a-year. It gets more costly since you ascend the education hierarchy – from around $8,000 so you can loans Goodnews Bay AK $twenty-two,100 a-year. According to Statistics Canada, prior to now seasons by yourself, student university fees charge have already improved from the step three.1 percent.

Homeownership is the newest imagine the baby Boomers. Now, Millennials is to get in on substantial costs, says Kelley Keehn, an individual financing instructor and user endorse for FP Canada. Whenever the Baby Boomer moms and dads made an appearance away from school, they’d almost no education loan financial obligation and not as much people went along to college. In any event, you’re almost protected employment. Today, its nearly expected you scholar having a diploma and you are still not going to get your dream occupations. It will require a lot of time.

Have a tendency to student loan loans hurt my possibility of being qualified to possess good home loan?

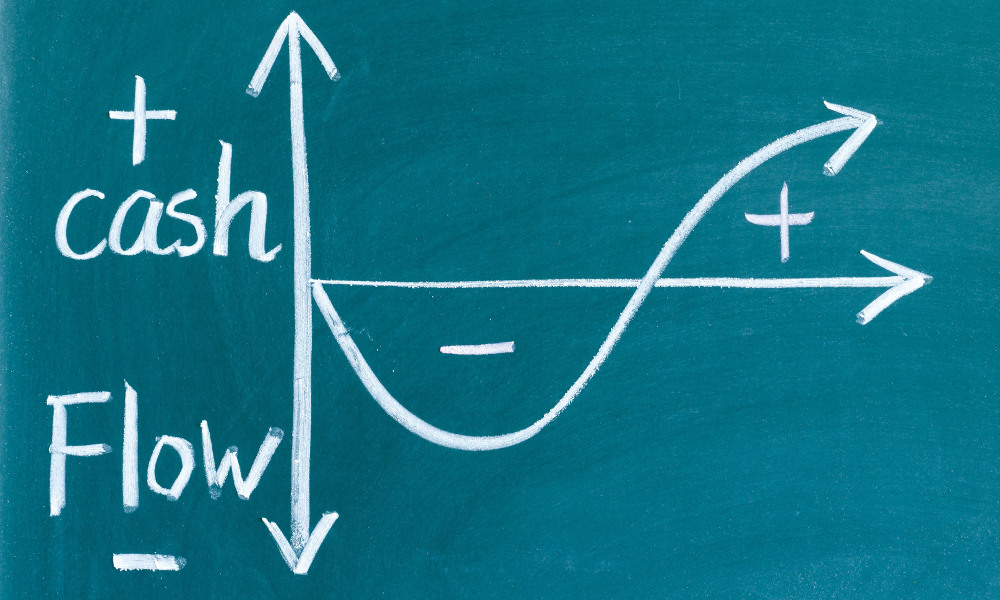

New bad news: if you would like go into the property field that have beginner loans it won’t be a cake walk. The good thing: you are able.

You could potentially hold loans whilst still being be eligible for a home loan. People understand this indisputable fact that you have to be debt-100 % free before you get a home. Generally speaking, I have not viewed many people exactly who just weren’t capable be eligible for a mortgage while they were still holding a student loan, claims Okun. Its moreso an issue if you is holding an excellent significant personal credit card debt otherwise provides a keen unsecured line of borrowing – which i carry out inform them to pay off basic.

Compared to the playing cards, figuratively speaking are one of the better expense to own. On top of that have lower-rates, seemingly flexible payment times and you can income tax vacation trips, student loans are accredited smaller harshly by the mortgage lender.