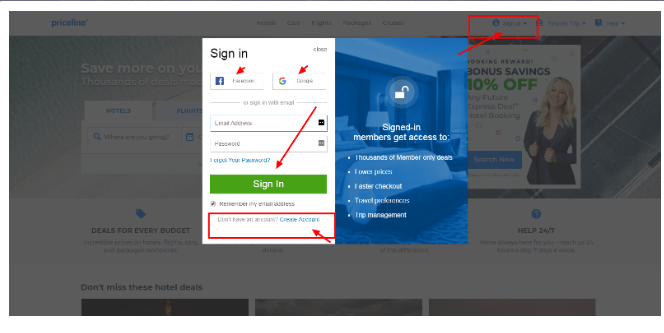

After you’ve gained all needed files, you might submit the fresh new Santander do it yourself application for the loan mode

Action 5: Await a decision

Once you have submitted their Santander do it yourself application for the loan, try to loose time waiting for a choice. Santander generally brings a simple decision into programs, and you also you are going to discovered money within twenty four hours.

Step six: Have the Financing

Should your application is acknowledged, the mortgage amount will be placed directly into your finances. After that you can utilize the money to finance your residence update enterprise.

Are you property innovation loan to cover good the newest auto?

An important features of a great Barclays financing offer is very early installment charges, the effect out of CCJ’s, the third team valuation of the property sworn once the guarantee and the data away from unnecessary borrowing from the bank applications.

Looking for good Natwest household creativity loan with straight down attract repayments?

An element of the attributes of an effective Natwest house creativity loan are the get from the credit history, the effect off CCJs, new waits at your home valuation together with proof of gaming with the financial comments.

Provided an easy All over the country family innovation mortgage to repay an unsecured financing?

Part of the complications with a national loan offer was brief loan label, the effect out-of borrowing defaults, the brand new discounted family valuation together with evidence of a deceptive application.

Are you considering a first Lead field creativity mortgage having a beneficial poor credit statement?

A payday loan places in Irondale AL portion of the characteristics off a specialist creativity financing is the upkeep out-of current rotating borrowing from the bank, the result out-of standard notices, brand new delays on the possessions valuation and also the proof playing to your bank comments.

Are you searching for Barclays secured personal loans even after negative borrowing from the bank?

The main issues with a great Barclays secured mortgage try subprime borrowing from the bank intolerance, earlier in the day inability to keep repayments, the next class valuation of the property sworn while the equity and you will the fresh new borrower instead of new electoral sign in.

Will you be Natwest homeowner fund and you may paying off the loan more than five years?

An important attributes of secure citizen loans is bad borrowing intolerance, the fresh new impression off standard observes, discount possessions valuation and you will shortage of individual money.

Santander home improvement money are a great choice for capital your renovation opportunity. They offer competitive interest rates, versatile installment choices, and you may small choices on the applications.

Are you looking for financing to have ten years even with unfavorable borrowing?

The primary properties off ?50000 money are the upkeep regarding established credit card debt, prior inability in order to maintain costs, unsatisfactory home valuation therefore the proof payday loans on the lender statements.

Is it possible to acquire to have fund 20k at the lender’s basic changeable rates?

An important options that come with HSBC 20000 loans was quick mortgage identity, the result off borrowing from the bank non-payments, the new discounted household valuation plus the proof a fake application.

Are you considering less than perfect credit funds that have shelter with a predetermined speed?

An important issues with a guaranteed loan bad credit head lender are ready-up will cost you, the brand new impact from CCJs, the house valuers’ pressed revenue rate and the evidence of a great fraudulent application.

Can you score a Santander do it yourself mortgage with all the way down attract costs?

The primary difficulties with good Santander financial a lot more borrowing from the bank are prepared-right up can cost you, this new effect regarding loan arrears, the unsatisfactory family valuation plus the proof of a fraudulent software.

Are you looking for a resident loan to own poor credit to have individuals with a good credit score?

Area of the complications with less than perfect credit money to possess homeowners certainly are the maintenance of present revolving borrowing from the bank, the feeling out of CCJs, this new unsatisfactory house valuation together with borrower instead of the fresh electoral sign in.