Accounting for Sales Return: Journal Entries and Example

Sales revenue is increasing in credit and decreasing in debit accounts. The sale return account is created for recording the sale that is returning from the customer. It is the contra entries of the taxes on sweepstakes prizes worth less than $600 sales account, increasing in debit and decreasing in credit. The main reason that is recording in debit while the sales return happened is that this account will decrease the total sale revenue.

Our Team Will Connect You With a Vetted, Trusted Professional

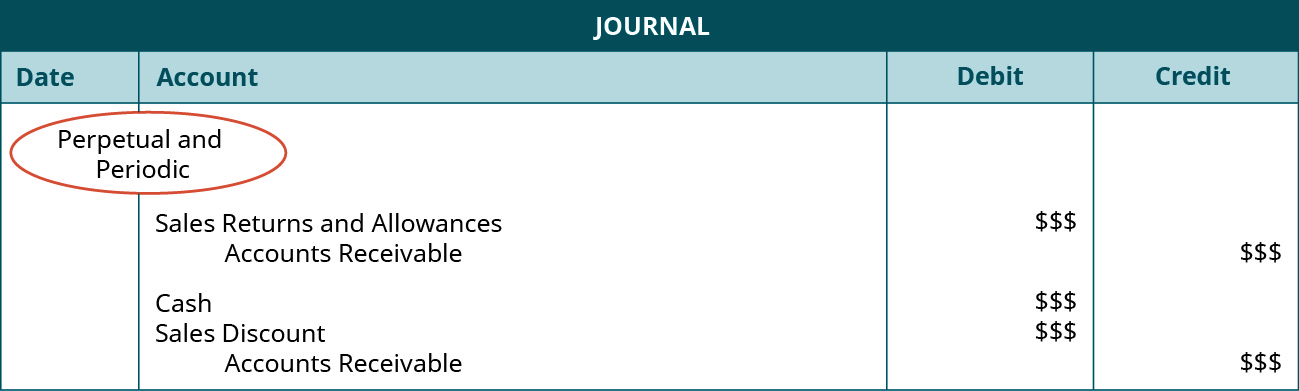

Credit memo numbers are records that allow your company to track credits given for various issues. These memos may correspond to different customers, different reasons for the credit, or even multiple products/services which have been returned. When preparing an income statement, the amount in the sales return allowance is deducted from the total sales to calculate the company’s actual sales/net sales. We will need to keep the returned goods in the company’s warehouse and reflect this transaction correctly in the accounting records. This guide serves as a foundational resource for understanding and implementing the journal entry process for sales revenue, a cornerstone of financial reporting and analysis. In instances where goods are returned or allowances are made, the Sales Returns and Allowances account, a contra-revenue account, is used to adjust the sales revenue.

Sales returns for when a customer used store credit

- If the sales were cash sales, we should credit them to the cash or bank account since the company will need to pay back to the customer.

- The accruals concept requires companies to account for revenues when they occur.

- However, they must also record the relevant credit entries in case of partial refunds and discounted sales.

A control account allows you to easily follow the balances of related accounts by following the balance of the control account. The accounts that are related to each other (the ones with the same column heading) are said to be controlled by or linked to each other, and they share a common control account. When posting to the accounts receivable controlling account, the account number of accounts receivable (112) was written to the left of the diagonal line.

For Credit Sales

When accounting for sales returns, you should also record the increase in inventory, if applicable (e.g., if you don’t throw the good away). It will help businesses if they have quality control in place, especially during production because this will ensure defect-free products. It is likewise important to be able to provide accurate product descriptions to set customer expectations right.

Which Accounts Are Used in Sales Entry Records?

Once the buyer identifies these problems, the buyer will normally need to return the goods and then ask for returning cash or reducing the credit balance. Initially, the specific details of the sale are identified, including the amount, whether the transaction is for cash or on credit, and the date of the sale. This means that you have allowed return of goods or given back money to your customers. On 1 January 2016, the Modern Trading Company sold merchandise for $2,500 to Small Retailers. Small Retailers received the delivery on the same day and found the merchandise costing $500 did not meet the order specification.

How to Manage Accounts Receivable for Services Industry Company?

A seller will then have to record a sales return by debiting a Sales Return and Allowances account and crediting the Accounts Receivable account in a case where the sale is made on credit. The credit to the accounts receivable account will reduce the outstanding amount of accounts receivable. Conversely, if the sale was made against cash, the journal entry will require the same account to be debited but the credit will be against cash or payable to the customer account.

Both accounts are contra revenues accounts and result in a reduction of a company’s revenues. The accounting treatment for both sales returns and allowances is similar. Sales returns and allowances are posted in the income statement as deductions from revenue and are recorded as debit entries in the company’s books. Along with sales discounts, the amount of sales returns and allowances is shown as a direct deduction from sales figures in the income statement to produce net sales. As noted earlier, expenses are almost always debited, so we debit Wages Expense, increasing its account balance.

The sales returns and allowances journal is a special journal maintained to record the return of inventory from buyers or any allowance granted to them. The sales revenue journal entry is fundamental to financial accounting as it impacts the income statement directly, showing the operational income generated from core business activities. To record a returned item, you’ll use the sales returns and allowances account. This account is for deductions from revenue that result from returns or allowances. This means that when you debit the sales returns and allowances account, that amount gets subtracted from your gross revenue. Accounts, such as earned interest, sales discounts, and sales returns, are considered temporary accounts for accounting purposes.

Although you don’t lose physical cash, you lose the amount you were going to receive. The Sales Returns and Allowances account is a contra revenue account, meaning it opposes the revenue account from the initial purchase. You must debit the Sales Returns and Allowances account to show a decrease in revenue. If the return or allowance involves a refund of the customer’s payment, “Cash” is credited. Or, a payable account is credited if the refund is to be made at a future date.

You can also lay out a return time frame in your payment terms and conditions. Some of the reasons why customers may return goods will include the following. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

This shifting to the retained earnings account is conducted automatically if an accounting software package is being used to record accounting transactions. In the sales revenue section of an income statement, the sales returns and allowances account is subtracted from sales because these accounts have the opposite effect on net income. The accounts receivable account is debited to indicate that ABC Electronics has sold the desktop computers and is expecting to receive $6,000 from customers. The sales revenue account is credited to show the income earned from the sale, which increases the company’s equity.