Your credit score try a primary grounds whenever trying to get funds

Credit score Conditions

This is because it offers lenders a glance at how good you’ve been in a position to pay-off your credit in the past, enabling all of them assess just how more than likely you are to expend right back the newest mortgage.

A lowered credit rating indicates possible risk in order to loan providers, that could cause them to refuse the job or accept itwith large rates or other products in position.

Because the FHA loans are covered from the federal government, lenders commonly quite as concerned about the chance you pose. Minimal credit history standards having FHA money usually are priced between five-hundred to help you 580believed Poor into the lower prevent regarding Fair Fico scoresaccording to sized your advance payment.

Financial Insurance rates

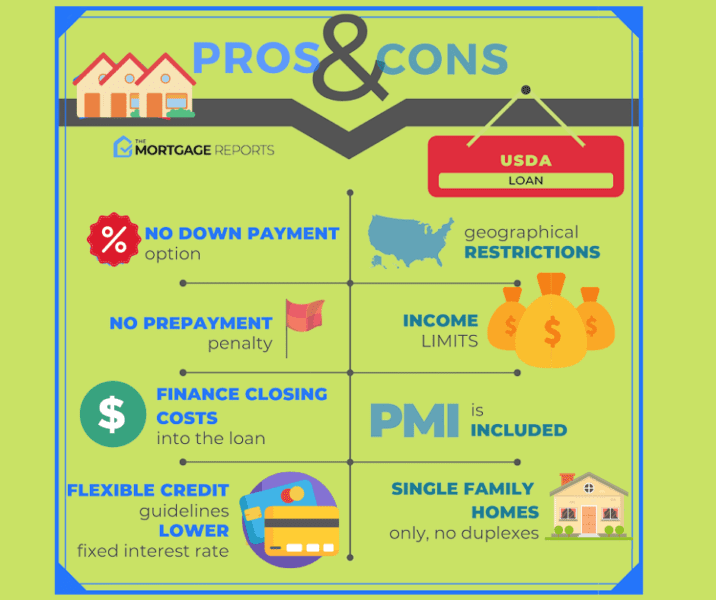

Personal Financial Insurance rates, otherwise PMI to have quick, is actually a way loan providers can protect by themselves otherwise pay back your loan.

Antique loan PMI is an additional prices to you personally, charged together with your month-to-month mortgage for a price away from roughly 0.58% to just one.86% of the loan amount. After you come to 20% collateral, you can consult to eliminate it. When you come to twenty-two% equity, it would be removed immediately.

The brand new upside out-of PMI conditions is that you could have the ability discover approved for a financial loan you would not if you don’t. Such as for instance, in case your credit try hanging merely inside the lowest 620 and their deposit is merely as much as 5%, PMI may give lenders enough promise to help you agree your getting a normal mortgage toward $five hundred,000 family.

For individuals who compare a conventional loan to your $500,000 home with a 20% downpayment as opposed to a 10% down payment having step 1% PMI up until getting 20% collateral, you can extremely notice improvement.

Regarding mortgage into the ten% down-payment, you’d need to pay $417 when you look at the PMI every month getting 100 months. That’s $41,667 from inside the PMI alone during the period of the loan!

With an effective $fifty,000 less loan to pay off through your deposit, might rescue $111,784 towards the PMI and you will attention through a 20% downpayment.

Due to the fact FHA money is actually covered of the federal government, they don’t really require private home loan insurance policies. Although not, FHA funds would need a home loan Advanced (MIP) that includes an initial (UFMIP) and you will yearly percentage.

UFMIP is actually step one.75% of one’s complete loan amount. MIP was 0.15% so you’re able to 0.75% of the mortgage per year, based the deposit and you may loan title.

With FHA finance, the mortgage top is not preventable otherwise centered on equity. Although not, if you make good 10% advance payment, you can prevent spending MIP just after 11 decades. You can also re-finance the loan in order to a traditional loan so you can shed the new superior.

Let us contrast an FHA loan into $five-hundred,000 house with a good step three.5% advance payment rather than a great ten% advance payment with an eleven-year MIP cycle.

On mortgage for the step 3.5% deposit, you will end up using $8,750 toward initial MIP, and a collective complete away from $79,613 with the 0.55% annual MIP.

On financial toward 10% down-payment, you’ll loans Boone spend the exact same $8,750 initial MIP, however, just $twenty-seven,225 to your annual MIP along the label of your loan.

That means that that have a deposit sufficient so you can meet the requirements to own an eleven-seasons MIP period, you might save your self around $52,387 to the yearly MIP. Just like the an advantage, might and help save over $45,000 in desire because of more substantial down payment and you may smaller mortgage.

We have found a part-by-top description evaluating all these four circumstances, all of these are based on a beneficial $five-hundred,000 property that have a 30-seasons financing name and you can 7.03% interest rate. Fees for example property income tax and you can homeowners insurance are not included: