Chat to a lender about your DTI

Lenders take a look at numerous things when choosing a prospective borrower’s degree to possess a home loan, and additionally credit history and you can business stability. Yet , of numerous hopeful buyers enter the pre-approval processes unsure their personal debt-to-money proportion. DTI, because it’s also referred to as in the business, is the portion of your revenue that visits paying your own repeating expenses.

Regrettably, a top DTI you may cause you to possibly shell out far more desire along side longevity of your loan. It may also function as reason why their home loan is declined. Let’s look closer from the how exactly to go about calculating and you may, fundamentally, lowering your DTI.

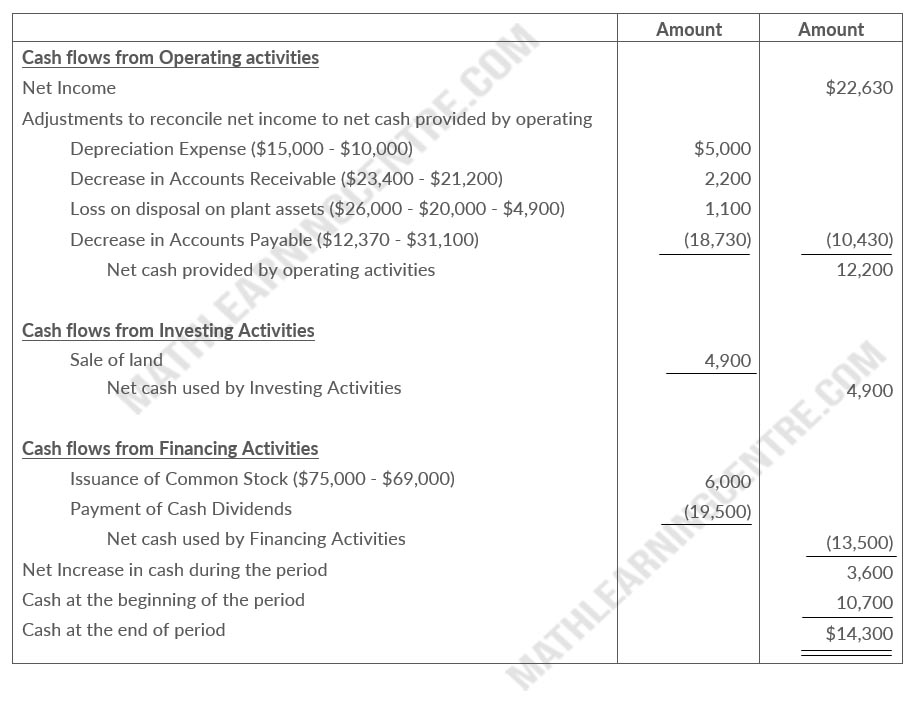

Ideas on how to calculate it

It’s actually pretty effortless. Only divide your own monthly obligations (car loan, education loan, personal loan, and you may minimum mastercard money) by the gross income. We will explore what is reported to be good personal debt-to-earnings ratio next section.

As important as DTI is generally, it is value noting that not most of the financial works out it the same ways. You may become dealing with a lender just who renders aside monthly expenditures like dining, tools, medical health insurance, and you may transport costs. Credit alerts customers to be acknowledged to obtain more than they truly are ready to buy their home loan.

What’s an excellent DTI

Lenders become preferred granting individuals with a DTI on or less than thirty six%. Now, what takes place if you this new mathematics a bunch of times but your ratio is available in a bit over the demanded thirty-six%? Not to ever care and attention, since the certain individuals might best personal loan lenders in Jacksonville have a good DTI as much as 43% and still become approved for a mortgage.

What if you are going from the pre-recognition processes and your lender return for the development that you scarcely qualify for a mortgage that have a beneficial 43% DTI. While you can be fortunate to order property, you definitely will not have far monetary go room even if away from a position losings or scientific disaster. This is exactly why loan providers like a great 36% DTI – the greater number of breathing room you have got at the conclusion of the new few days, the simpler its to withstand changes on costs and you will earnings.

Strategies for decreasing they

Even though you have increased DTI now doesn’t mean you simply can’t down it prior to speaking with a loan provider throughout the near future. Here are some tips in making that it proportion more appealing having lenders:

End taking on much more financial obligation – Hold off thereon hunting spree or trips until after you’ve gone in the new house.

Pay off your debt before you apply to possess a home loan – This may plus help you stop more notice away from accruing.

Avoid your own mastercard to possess big orders before you buy a property – Including larger instructions for your home, particularly seats and you will appliances)

Home a high paying occupations or a raise at the current boss – According to your position where you work, this might be easier said than done. That said, getting a higher paycheck allows you to reduce your DTI nearly instantaneously.

How exactly to check your DTI

Individuals will want to look at over the DTI whenever choosing how much family they may be able pay for. Since your financial is inform you, your DTI is only an article of the new mystery. It is in addition crucial to take into account typical expenses like dining, resources, medical health insurance, transportation will set you back, while the unexpected night out.

In the event the DTI was closer to 50% than simply thirty-six%, you really don’t want to initiate your house to buy techniques somewhat yet. We obtain it – the housing market remains gorgeous while need certainly to getting an effective homeowner sooner rather than later. not, the very last thing for you to do is actually undertake an enthusiastic unlikely mortgage repayment along with your current debt obligations.

Take some time today to really get your earnings managed, if which means repaying bank card balances, reducing too many expenditures, and/or complementing your revenue that have a moment jobs. Even when lowering your DTI means many discipline, your time and efforts will pay returns when you’re ready to really mention to shop for a home. Again, lenders prefer consumers which have a good credit score and restricted personal debt.

We just threw an abundance of guidance from the you out of obligations-to-earnings proportion. There is absolutely no matter one calculating DTI will be tiring, aside from learning simple tips to all the way down it. For this reason we suggest getting in touch with a talented financial. He or she can assist you inside learning their greatest homeloan payment, whether or not your house purchasing preparations is actually temporarily on keep.