How to Save yourself More cash With an ally Family savings?

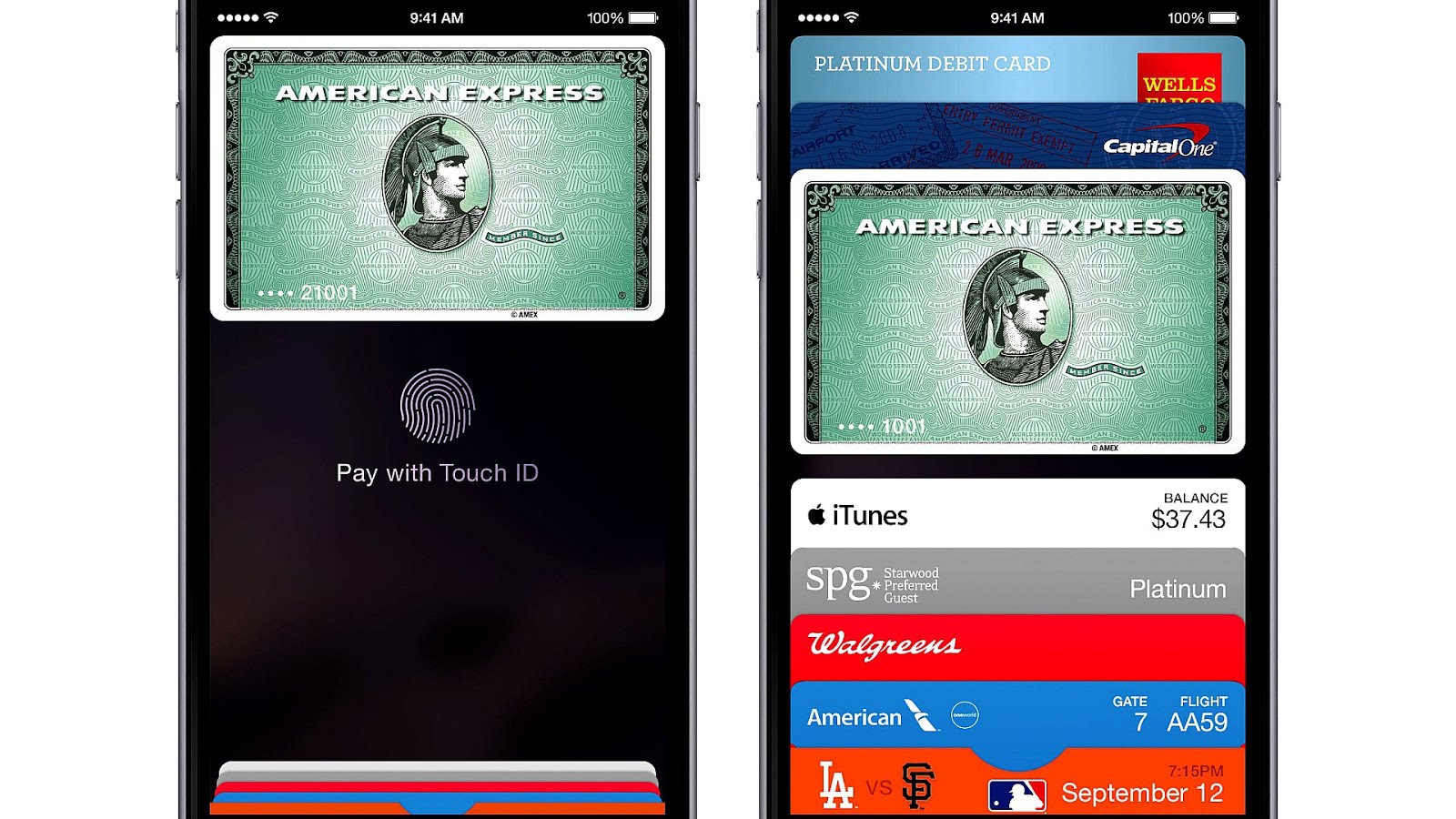

Ally Lender makes it incredibly accessible your bank account, no matter which membership you may have. You could make places, distributions and you may transmits with general ease. You could log into your online account into the bank’s webpages to handle all of one’s account. Can be done the same thing on the smartphone on the bank’s cellular software. Here, you’ll be able to deposit inspections having Friend Financial eCheck Put. It’s also possible to phone call customer service to deal with your account.

How many moments you could make in initial deposit into the membership will depend on the new membership variety of, whether a timeless checking account, a finance markets membership otherwise a beneficial Computer game. Most of the account designs will accept any kind off commission, but dollars. Distributions and you may outbound transfers try a new amount, but not. For each and every federal legislation, you are limited by half dozen outgoing deals each declaration duration.

And work out a cable tv transfer, you’ll have to make a request on the web with the on the internet cord transfer means. There will be a $20 payment for delivering a residential wire import. It is possible to print out a domestic wire import form out of the site and you can fax it to the amount considering to the web site.

Thank goodness, you’ve got easy access to Friend Bank representatives. If you ever have concerns or are unsure just how so you’re able to ideal availability your account, you might provide them with a visit.

Ally Financial is amongst the couples metropolitan areas you can purchase for example highest-making rates. You could expect large banking institutions including Pursue and you will Bank of America to own best pricing to possess offers accounts. Yet not, they supply simply 0.01% return on the coupons profile, not even coming alongside Friend Bank’s choices.

By using an ally Bank family savings, you can generate more funds instead of really needing to manage much alot more. You have made many shell out quicker, particularly in fees.

What if you deposit $5,000 on a free account that have good 0.01% APY. Immediately after annually, you get only fifty cents. If you decide to put $5,000 towards a friend Lender bank account on the APY away from 4.20%, you have made $210 immediately following a year. If you decided to consistently put more cash into the Friend Bank account, your revenue will be a lot more than just one.

What’s the Process to have Opening an account With Ally Financial?

Since there are no bodily Ally Lender twigs, attempt to unlock a free account sometimes on the internet or by the calling its customer service contact number. You can incorporate because of the mailing regarding requisite versions, however, that really needs printing out regarding the site, so you could too only incorporate on line.

On the web, it is as simple as finding the account you would like to open and you can clicking the fresh new option that checks out Discover Membership. Just be sure to promote information just like your Personal Protection number, the United states mailing target and your ages. Just be about 18 yrs old to open up an account.

If you wish to open a merchant account due to the fact a joint account otherwise once the a rely on, you could potentially believe that using your application.

What is the Catch?

A large part of Friend Lender is the fact its completely online, without the physical branches. That is a giant plus to many, however, just as a serious pain for other individuals. Either you only need to correspond with a guy deal with-to-deal with and indication records instantly. So if you most value those individuals regions of a lender and should not bank with an online software as with this analogy, financial with Friend Lender gets difficult to you personally.