6: Constraints towards the Charges and you may Settlement costs

- Downpayment Required: $ (25% x $20,350)

So it same get determined using a conventionally funded (low Virtual assistant) mortgage system you certainly will need the customer to get 5%, 15% or even 20% down.

Antique Loan

- 5% Downpayment: $29,000

- 15% Down payment: $90,000

- 20% Down payment: $120,000

- 5% Downpayment: $thirty five,000

- 15% Advance payment: $105,000

- 20% Down payment: $140,000

Clearly, there is a critical work for to possess Servicemembers and you will Veterans in the event it comes to the level of cash you’ll need for an advance payment when purchasing a home.

4: Competitive Interest rates

Once the Va pledges a portion of all Va loan, loan providers could offer straight down rates of interest so you can Va individuals no credit check payday loans Bonanza Mountain Estates. Rates depend on new inherit chance thought of the financial to finance the mortgage. New VA’s verify brings loan providers with a sense of security one to lets them to charge well down cost.

Into the a 30-year $250,000 mortgage, the essential difference between investing an effective 4 per cent and you will cuatro.75 % rate can indicate just as much as $forty,000 inside the discounts over the life of the loan.

5: Informal Borrowing Criteria

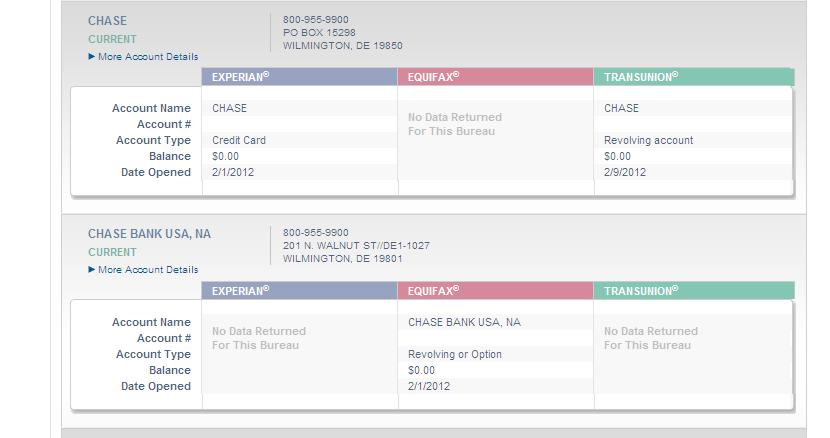

Since Institution out-of Veterans Factors only manages the mortgage system and will not actually material finance, the fresh agencies does not lay otherwise demand credit score minimums. Although not, extremely Virtual assistant lenders play with credit history benchmarks to gauge a great borrower’s risk of default. Normally, loan providers select a credit history of at least 620. While doing so, Va Lenders are typically be more forgiving with regards to so you can jumping back shortly after a bankruptcy proceeding or foreclosures.

Getting a traditional financing, Veterans will often have to satisfy a higher benchmark. The average conventional customer got an excellent FICO get on fifty issues more than the common Va consumer for the 2016.

Most of the mortgages incorporate charge and you will closing costs. However the Va in fact restrictions exactly what Veterans is going to be energized when it comes to this type of costs. Some costs and you will costs have to be included in most other people in the transaction. These types of defense make homeownership economical to possess licensed homeowners.

Virtual assistant individuals can also query a seller to expend each one of their financing-related closing costs or more in order to 4 per cent during the concessions, which can safeguards things such as prepaid fees and you will insurance coverage, repaying collections and you will judgments and. There’s absolutely no make sure the vendor commonly agree to one to consult, however, Veterans can certainly ask into the discussion techniques.

7: Lifestyle Benefit

One of the most popular misconceptions towards Virtual assistant home loan system is the fact its a single-go out work with. Indeed, people who’ve generated it can use this program over repeatedly once more throughout their lifetimes. Despite whatever you decide and have often heard, you do not fundamentally need to pay right back their Va mortgage in complete locate a differnt one.

Its actually you’ll to possess multiple Va mortgage at the the same time. Making use of your home loan work with many years ago does not always mean you may be no more qualified. Neither does it signify since you provides an effective Va home loan at the most recent obligation station, you simply cannot buy once more having good Virtual assistant mortgage after you Pcs all over the country. When you yourself have any queries concerning your Virtual assistant financing entitlement or what would become you can, contact us and we will set you touching good VA-official lender.

Many people see the amount of money they can conserve by paying off their loan early, but they are have a tendency to obligated to spend prepayment punishment if they would you like to to take action. Prepayment penalties are created to protect loan providers about financial losings from losing many years of focus repayments for the awarded fund. The good news is to the Virtual assistant Home loan benefit, you could repay the loan very early and you may without fear of of every prepayment punishment.